Advanced Fraud Tools

Sertifi Advanced Fraud Tools bring a higher level of security and reliability to Sertifi eAuthorizations. With a combination of smart technology and data analysis, these tools automatically assess new transactions for signs of potential fraud. Hotel staff can review the risk analysis score before deciding on whether or not to proceed with a transaction.

Advanced Fraud Tools are currently only available for transactions in eAuthorization workflows.

Using Advanced Fraud Tools

Advanced Fraud Tools will always run automatically in the background and provide a score for a transaction. No further action is required on your part.

Understanding Your Score

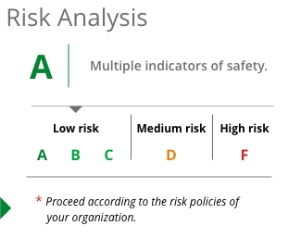

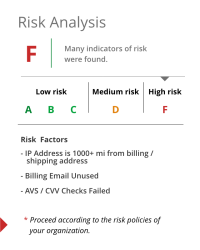

For each payment in a given contract, you'll see an assigned letter grade within the Fraud Score column. This grade is an estimation of the overall safety of the transaction.

- Transactions rated A, B, or C have been determined to have a lower level of risk.

- Transactions with D grades are notably affected by one or more risk factors.

- The riskiest transactions are rated F.

Score Factors

Multiple factors are considered when determining a transaction’s Fraud Score. These factors include, but are not limited to:

- Payment card

- Authorization status (approved/not approved)

- Merchant ID

- Billing address

- AVS/CVV verification

- Payer email address

- Payer IP address

Product Guides

Additional Resources

Chargebacks and Fraud (Infographic)

Chargebacks and Best Practices (Infographic)

Sample Authorization Form for Identifying Fraud

Advanced Fraud Tools One-Page Summary