Sertifi and AVS

AVS (Address Verification System) validates that the numerical information of payer's address (address and zip code) matches the numerical address information provided to an issuing bank. Running an AVS check on the payments or authorizations you accept can help ensure the payment or authorization is valid.

This article contains the following sections:

AVS Status

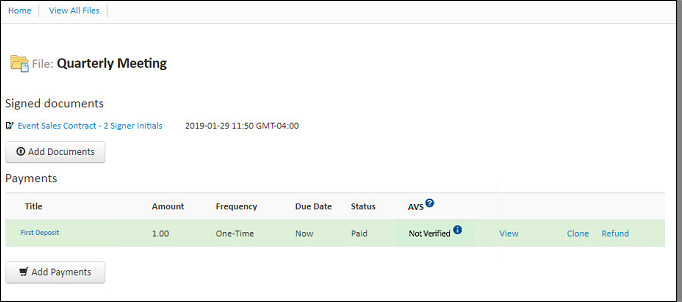

When an AVS check is run against a payment or authorization, you can view its status in the Sertifi Portal on the file maintenance page. You'll see one of the following statuses:

- Match - denotes the information submitted by the payer matches the information acquired during the AVS verification.

- Partial Match - denotes that some of the information submitted by the payer matches some of the information acquired during the AVS verification.

- Not Verified - denotes that AVS couldn't run or AVS isn't supported by the issuing bank, or another issue occurred during the AVS verification.

A status of Not Verified does NOT mean that an error occurred. It means that the AVS check isn't supported by the issuing bank or another issue occurred. You might be set up with your payment gateway to automatically accept payment methods with a Not Verified status. If you'd like to automatically reject these payments, request that your Sertifi Super Admin reaches out to Sertifi Support.

Match messages

- The street address and the U.S. ZIP+4 code match.

- The street address and postal code match.

Partial Match messages

- The street address matches, but the postal code doesn't match.

- The postal code matched, but the street address doesn't match.

- The U.S. ZIP+4 code matches, but the street address doesn't match.

Not verified messages

- No address information was provided.

- The AVS check returned an error.

- The card was issued by a bank outside the U.S. that doesn't support AVS.

- Neither the street address nor postal code matched.

- AVS isn't applicable for this transaction.

- AVS was either unavailable or timed out.

- AVS check isn't supported by card issuer.

- The address information is unavailable.

AVS Best practices

As a best practice, you might want to reach out to payers for additional verification if you receive a partial match or not verified message for an AVS verification. If you've elected to accept partial matches, and would prefer to decline partial matches up front, request that your Sertifi Super Admin reaches out to Sertifi Support to make this change.

Unsupported AVS checks

For payment gateways that don't have AVS enabled, you won't see an AVS status for your payments or authorizations. Instead, you see a dash where the AVS status should be. The gateways that don't support AVS include:

- Payeezy

- Zuora

- Check Commerce

- US Bank

You also won't see an AVS status if the transaction type doesn't support AVS - like a cloned payment. In these cases, you'll also see a dash where the AVS status should be.